- Geha Hdhp Copay

- Hdhp Copay

- Aetna Hdhp Copay

- High Deductible Health Plan Copay

- Ppo Vs Hdhp Comparison Grids

- Hdhp Vs Copay

- Hdhp Vs Copay Calculator

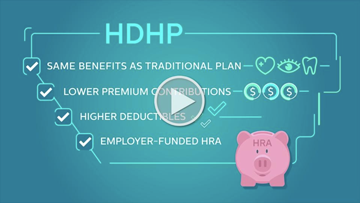

What’s considered a High Deductible Health Plan? Under the tax law, HDHPs must set a minimum deductible and a limit, or maximum, on out-of-pocket costs. For calendar year 2021, these amounts for HDHPs are: Minimum deductible (The amount you pay for health care items and services before your plan starts to pay). .Under the High Deductible Health Plan (HDHP), your deductible is $1,500 for Self Only coverage, and $3,000 for Self Plus One or Self and Family coverage. With the exception of preventive care, vision and dental, you must pay the full deductible before GEHA pays for your health care. In order to put money into an HSA you are required to have a High Deductible Health Plan (HDHP) in effect for either you or your family. A HDHP is simply health insurance that meets certain minimum deductible and maximum out-of-pocket expense requirements. This table shows the limits for HSA's in. A High Deductible Health Plan (HDHP) has low premiums but higher immediate out-of-pocket costs. Employers often pair HDHPs with a Health Savings Account (HSA) funded to cover some or all of your deductible. You may also deposit pre-tax dollars in your account. Learn about the differences between a high-deductible health plan and a copay plan to see which is right for you. Video Transcript. Medical Mutual and your employer are working hard to make sure you have choices and health benefits that fit your medical needs and your budget. If your employer offers a choice between a standard copay plan and a.

Geha Hdhp Copay

Key takeaways

- High-deductible health plans must conform to established federal guidelines.

- HDHPs are the only plans that allow an enrollee to contribute to a health savings account.

- HDHPs cover preventive care before the deductible (and insurers now have flexibility to include some chronic care treatments under the umbrella of preventive care, but the health plan cannot pay for nonpreventive services until the insured has met the deductible.

- The IRS has implemented transitional relief, through 2019, for plans that cover male contraception before the deductible.

- With an HDHP, the policyholder pays out of pocket for everything other than preventive care (and if allowed by the insurer, COVID-19 costs) until the deductible is met.

- HDHPs have annually-set guidelines for allowable deductibles and out-of-pocket costs.

- For 2020, HSA contribution limits are $3,550 for an individual and $7,100 for a family. These amounts will increase to $3,600 and $7,200 for 2021.

- HSA funds can be used at any time, tax-free, to cover qualified medical expenses. After age 65, they can be withdrawn without a penalty for non-medical expenses, but income tax would apply in that case.

- HDHP premiums are usually among the lower-cost plans, but they’re typically not the least expensive.

What is a high-deductible health plan?

In lay terms, a high-deductible health plan could simply be considered a policy with a high deductible. But the term “high-deductible health plan,” or HDHP, is specific to plans that not only have high deductibles, but also conform to other established federal guidelines.

Can I combine a high-deductible health plan with an HSA?

HDHPs are the only plans that allow an enrollee to contribute to a health savings account (HSA). High-deductible insurance is considered a type of consumer-driven health plan, so you may hear the term CDHP used in conjunction with these plans. The idea is to give patients control over how to spend and invest their money.

HDHPs cover preventive care before the deductible – the ACA requires this of all plans – but under an HDHP, no other services can be paid for by the health plan until the insured has met the deductible. That means HDHPs cannot have copays for office visits or prescriptions prior to the deductible being met (as opposed to a plan that’s got a high deductible but also offers copays for office visits from the get-go; people might generally consider the latter to be a high deductible plan, but it’s not an HDHP).

But in 2020, to address the COVID-19 pandemic, the IRS issued guidelines that allow HDHPs to pay for COVID-19 testing and treatment before the member has met the deductible. Federal rules require virtually all health plans, including HDHPs, to cover COVID-19 testing with no cost-sharing. But it’s optional for insurers to cover treatment with no cost-sharing, so this varies from one insurer to another.

And the IRS also issued new guidelines in mid-2019, expanding the list of preventive services that can be covered pre-deductible on an HDHP, with enrollees retaining their HSA eligibility. The new rules allow certain treatments related to certain chronic conditions to be classified as preventive care for HDHP purposes. These include:

- Congestive heart failure or coronary artery disease: ACE inhibitors and/or beta blockers

- Heart disease: Statins and LDL cholesterol testing

- Hypertension: Blood pressure monitor

- Diabetes: ACE inhibitors, insulin or other glucose-lowering agents, retinopathy screening, glucometer, hemoglobin A1c testing, and statins

- Asthma: Inhalers and peak flow meters

- Osteoporosis or osteopenia: Anti-resorptive therapy

- Liver disease or bleeding disorders: International Normalized Ratio (INR) testing

- Depression: Selective Serotonin Reuptake Inhibitors (SSRIs)

The IRS does not consider male contraception to be preventive care, but some states have begun mandating male contraceptive coverage on all plans. The IRS is considering new rules on this, but through the end of 2019, the IRS still considered a plan to be HSA-qualified if it covers male contraception before the deductible.

So with an HDHP, you’ll have to pay out-of-pocket for everything other than preventive care until you hit your deductible (as noted above, there are exceptions for COVID-19 testing and treatment, and the list of allowable preventive care benefits that can be covered pre-deductible by HDHPs is more extensive than the regular list of preventive care benefits that are required to be covered with no cost-sharing by all plans). After that, the insurance will pay benefits based on the plan’s coinsurance level (many HDHPs have 100 percent coverage after the deductible).

Autocad for apple mac.

Minimum deductibles and maximum out-of-pocket

HDHPs have specific guidelines in terms of allowable deductibles and out-of-pocket costs. These are adjusted annually by the IRS, although there have been some years when there were no changes.

For 2020 coverage, HDHPs must have deductibles of at least $1,400 ($2,800 for a family) and out-of-pocket caps that don’t exceed $6,900 ($13,800 for a family). Note that this is lower than the total out-of-pocket allowed on non-HDHPs under the ACA; the gap between the maximum allowable out-of-pocket limit for HDHPs versus other health plans has been steadily widening since the ACA was implemented.

For 2021, the minimum deductibles for HDHPs are unchanged ($1,400 for an individual, $2,800 for a family), but the maximum allowable out-of-pocket caps will increase to $7,000 for an individual and $14,000 for a family.

But not all plans that fall within these dollar limit guidelines are HDHPs, since HDHPs are also required to only cover non-preventive services after the enrollee has met the deductible.

HSA contribution limits

To help pay these out of pocket costs, it’s both wise and typical to pair your high-deductible plan with a health savings account (HSA).

For 2019, the contribution limits rose to $3,500 for an individual and $7,000 for a family. Policy holders normally have to make their contributions by April 15 of the following year (ie, the tax filing deadline), but the contribution deadline was extended for 2019 due to the COVID-19 pandemic. People who had HDHP coverage in 2019 have until July 15, 2020 to make some or all of their HSA contributions for 2019.

If you’re 55 or older, you can contribute an extra $1,000 a year. This amount is not indexed for inflation.

Hdhp Copay

If you’re HSA-eligible in 2020, you can contribute up to $3,550 to an HSA if your HDHP covers just yourself, and up to $7,100 if it also covers at least one other family member.

The contributions limits will increase again for 2021: People with self-only HDHP coverage in 2021 will be able to contribute up to $3,600 to an HSA, and those with a plan that covers at least one other family member will be able to contribute up to $7,200.

The money that you contribute to an HSA will reduce your ACA-specific modified adjusted gross income – or MAGI – (which determines your eligibility for premium subsidies in the exchange). In some cases, selecting an HDHP and contributing to an HSA could help a household avoid the ACA’s subsidy cliff, so it’s an option to consider if you find yourself with just a little bit too much income to qualify for premium subsidies.

How can HSA funds be used?

This money in your HSA is yours to withdraw, tax-free, at any time, to pay for medical expenses that aren’t covered by your high-deductible policy. You can reimburse yourself after the fact if you prefer – so if you incur a medical expense in 2020 but pay for it without withdrawing money from your HSA, you can opt to reimburse yourself for that spending several years down the road, as long as you keep your receipts.

If you take money out of your HSA for anything other than a qualified medical expense, you’ll pay taxes on the withdrawal, plus a penalty. But once you turn 65, the HSA functions in much the same way as a traditional IRA: you can pull money out for any purpose, paying only income taxes, but no penalty. You also have the option to just keep the money in the HSA and use it to fund long-term care later in life. The money is never taxed if you’re withdrawing it to pay for qualified medical expenses, even if you’re no longer covered by an HDHP at the time that you make the withdrawals. But contributions to the HSA can only be made while you have in-force coverage under an HDHP.

Aetna Hdhp Copay

You can also withdraw money from your HSA to pay Medicare premiums (for Part A, if you don’t get it for free, and for Parts B and D, but not for Medigap plans), or to pay long-term care premiums. There are limits, based on age, on how much you can pull out of your HSA to pay long-term care insurance premiums with pre-tax money (the following limits are for 2020; they’re indexed for inflation each year by the IRS). If your age is:

High Deductible Health Plan Copay

- 40 or younger, you can withdraw $430 tax-free to pay long-term care insurance premiums

- 41 to 50, you can withdraw $810

- 51 to 60, you can withdraw $1,630

- 61 to 70, you can withdraw $4,350

- 71 or older, you can withdraw $5,430

How do HDHP premiums compare to other plans?

Ppo Vs Hdhp Comparison Grids

In terms of premiums, HDHPs are usually among the lower-cost plans available in a given area, but they’re typically not the least expensive plans. That’s because the rules that govern maximum out-of-pocket costs for HDHPs are different from the rules that govern maximum out-of-pocket costs for all ACA-compliant plans. In 2014, the two were equal: the maximum allowable out-of-pocket for HDHPs was $6,350 for an individual and $12,700 for a family, and those were the same limits that applied to all ACA-compliant plans. So in that year, HDHPs were among the least expensive plans available.

But as time went on, the limits that apply to all ACA-compliant plans climbed faster than the limits that apply to HDHPs. For 2020, HDHPs can have a maximum out-of-pocket of $6,900 for an individual and $13,800 for a family. But the 2020 upper limit for out-of-pocket costs on ACA-compliant plans is $8,150 for an individual, and $16,300 for a family. So there are non-HDHP plans available that have higher out-of-pocket exposure (and thus lower premiums) than HDHPs.

Hdhp Vs Copay

This gap will continue to widen in 2021: The upper limit on out-of-pocket costs for HDHPs will be $7,000 for an individual and $14,000 for a family, but the maximum out-of-pocket caps for all other plans will increase to $8,550 for a single person and $17,100 for a family.

Hdhp Vs Copay Calculator

If being able to contribute to an HSA is a priority for you, you’ll want to focus on the HDHPs available in your area. But if the premium is your primary concern and you don’t plan to contribute to an HSA, you may find less-expensive plans that aren’t HDHPs, and that have higher out-of-pocket exposure than the available HDHPs.